So, you’re curious about the currency in Zimbabwe, huh? Well, let me tell you, it’s a fascinating story. Zimbabwe has had quite a tumultuous history when it comes to its currency, with hyperinflation running rampant and a legitimate currency crisis. But fear not, my friend, because I’m here to give you all the juicy details about what exactly is going on with the Zimbabwean currency. From the infamous Zimbabwean dollar to the current multi-currency system, we’ll uncover the ins and outs of Zimbabwe’s monetary landscape. Get ready for a wild ride!

History of Zimbabwe’s Currency

Rhodesian Dollar

The history of Zimbabwe’s currency dates back to the years when the country was known as Rhodesia. Before gaining independence from British colonial rule in 1980, Zimbabwe used the Rhodesian Dollar as its official currency. The Rhodesian Dollar, which was introduced in 1970, had different denominations, including banknotes and coins. However, due to the political and economic changes during the transition to independence, a new currency had to be established.

Zimbabwe Dollar (first)

Following independence in 1980, the Zimbabwe Dollar became the official currency of the newly formed nation. The Zimbabwe Dollar was introduced to replace the Rhodesian Dollar at a rate of 1:1. Initially, the currency was stable, and its value was on par with major international currencies. Banknotes of various denominations were introduced, ranging from one dollar to higher denominations.

Zimbabwe Dollar (second)

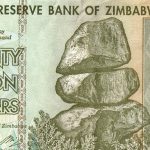

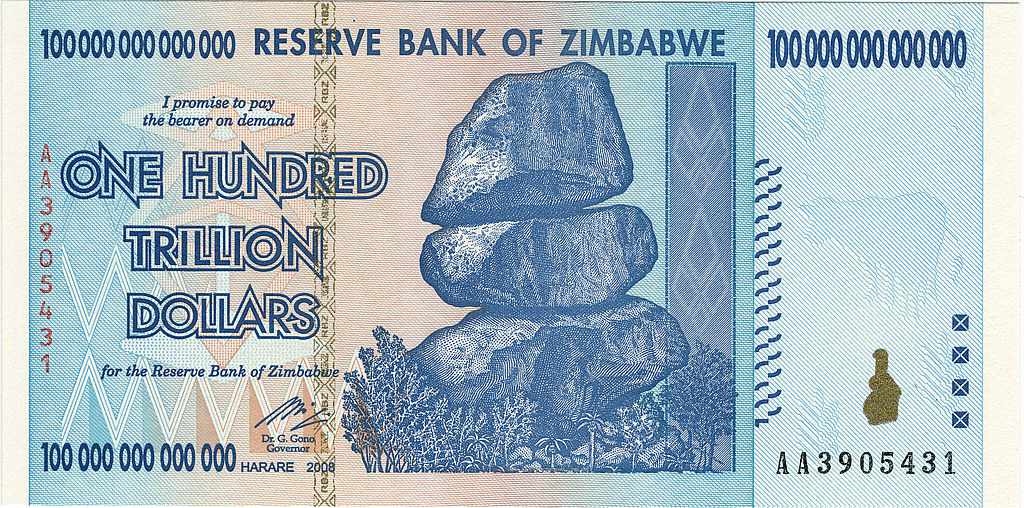

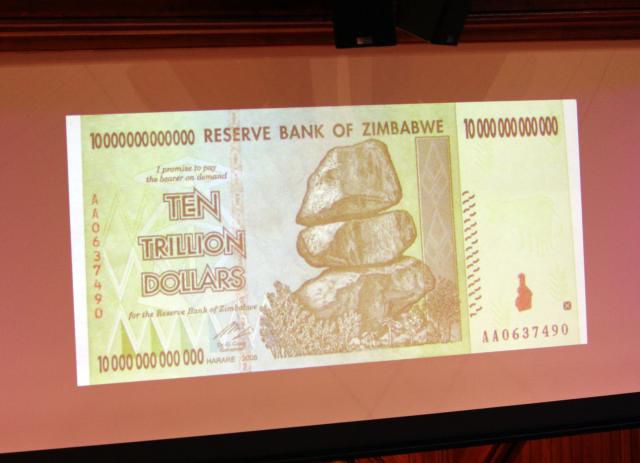

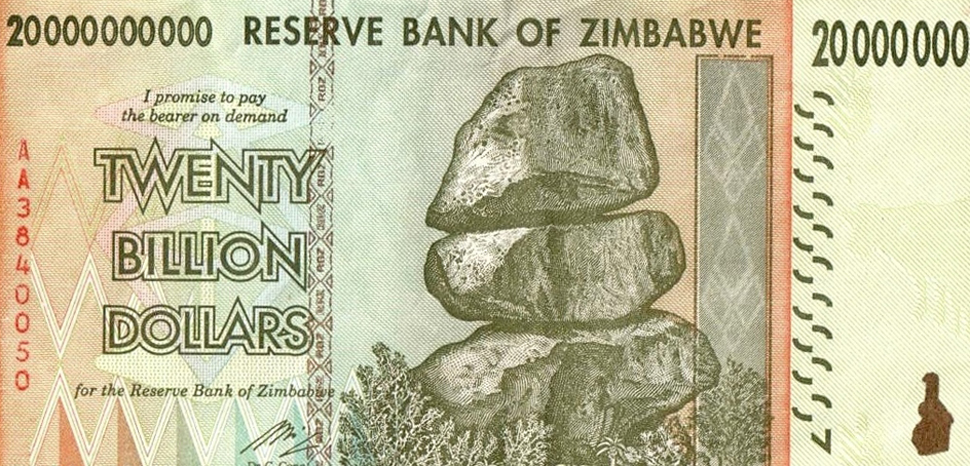

However, economic and political challenges in the 1990s led to a series of economic reforms that severely impacted the value of the Zimbabwe Dollar. In an effort to manage hyperinflation and stabilize the economy, the Reserve Bank of Zimbabwe revalued the currency in 2006, removing three zeros from its value. Despite these efforts, the Zimbabwe Dollar continued to lose value, and a second series of currency notes was introduced in 2009.

The Zimbabwe Dollar’s Demise

Hyperinflation

One of the primary reasons for the demise of the Zimbabwe Dollar was hyperinflation. Hyperinflation occurs when prices rise at an incredibly fast rate, eroding the value of the currency. In 2008, Zimbabwe experienced one of the highest hyperinflation rates in history, with annual inflation reaching a staggering 89,700,000,000,000,000,000,000% in November that year. The rapid increase in prices made the Zimbabwe Dollar essentially worthless and contributed to its downfall.

Abandonment of Local Currency

With the exponential depreciation of the Zimbabwe Dollar due to hyperinflation, the trust and confidence in the currency rapidly evaporated among the general public. Many businesses and individuals resorted to conducting transactions using alternative means, such as bartering or using foreign currencies. This widespread abandonment of the local currency further accelerated its demise.

Adopting Multi-Currency System

In 2009, in an effort to stabilize the economy, the Reserve Bank of Zimbabwe decided to adopt a multi-currency system, allowing the use of foreign currencies alongside the Zimbabwe Dollar. The United States Dollar, South African Rand, and other major currencies became widely accepted forms of payment. This move helped alleviate some of the economic challenges faced by the country, as it provided a more stable and trusted medium of exchange.

Adoption of Foreign Currencies

US Dollar

The United States Dollar became widely used in Zimbabwe after the adoption of the multi-currency system. It quickly became the primary currency for many transactions, including daily purchases, payments, and saving. The stability and global recognition of the US Dollar made it an appealing choice for both businesses and individuals in Zimbabwe.

South African Rand

Alongside the US Dollar, the South African Rand also gained popularity as an alternative currency in Zimbabwe. Due to the proximity of Zimbabwe and South Africa, cross-border trade between the two countries increased, resulting in the widespread use of the Rand. The South African Rand provided another option for Zimbabweans to conduct transactions and protect themselves from the volatility of the Zimbabwe Dollar.

Other Currencies

While the US Dollar and South African Rand were the most commonly used foreign currencies in Zimbabwe, other major currencies such as the British Pound, Euro, and Chinese Yuan were also accepted in some establishments. The availability of multiple foreign currencies provided flexibility for businesses and individuals, allowing them to choose the currency that best met their needs.

Return of the Zimbabwe Dollar

Introduction of Bond Notes

In an attempt to reintroduce a local currency, the Reserve Bank of Zimbabwe introduced bond notes in November 2016. Bond notes were meant to address the shortage of physical US Dollar banknotes in circulation. However, due to the lack of trust in the government’s ability to manage the monetary system and concerns about potential inflation, the acceptance of bond notes was met with skepticism.

RTGS Dollar

In February 2019, the Reserve Bank of Zimbabwe launched the Real Time Gross Settlement (RTGS) Dollar as the country’s official currency. The RTGS Dollar was a digital currency, consisting of electronic balances held in bank accounts. It was initially pegged to the US Dollar but later allowed to fluctuate on the foreign exchange market. The introduction of the RTGS Dollar aimed to provide a separate and distinct currency for local transactions.

Presidential Announcement

In June 2019, President Emmerson Mnangagwa announced the reintroduction of the Zimbabwe Dollar as the only legal tender in the country, effectively ending the use of foreign currencies for domestic transactions. The move was seen as an attempt to regain control over the country’s monetary policy and reduce its reliance on foreign currencies. However, the announcement was met with mixed reactions, as concerns about the stability and purchasing power of the Zimbabwe Dollar persisted.

Current State of Zimbabwe’s Currency

Usage of Zimbabwe Dollar

Following the reintroduction of the Zimbabwe Dollar, the currency is now widely used for both cash and electronic transactions within the country. Banknotes of various denominations, including 2, 5, 10, 20, and 50 Zimbabwe Dollar denominations, have been issued. However, the limited supply of physical banknotes and ongoing concerns about the currency’s stability pose challenges to its widespread usage.

Foreign Currency Transactions

While the Zimbabwe Dollar is the official currency for domestic transactions, the use of foreign currencies persists in certain sectors of the economy. Many businesses, particularly those involved in international trade or tourism, continue to accept foreign currencies as a form of payment. This practice ensures a level of stability and confidence for both businesses and customers, given the fluctuating nature of the Zimbabwe Dollar.

Currency Challenges

The Zimbabwe Dollar continues to face challenges in maintaining its value and stability. Factors such as limited foreign exchange reserves, a trade imbalance, and a fragile economy contribute to the currency’s vulnerability. Furthermore, the lack of confidence in the Zimbabwe Dollar among the general population and the memory of past hyperinflationary episodes create an ongoing hurdle for the currency to regain widespread acceptance.

Currency Exchange in Zimbabwe

Official Exchange Rate

The Reserve Bank of Zimbabwe sets an official exchange rate for the Zimbabwe Dollar against major foreign currencies. This rate is mainly used by financial institutions and government entities for accounting and official purposes. However, the official exchange rate often differs significantly from the rates offered in the unofficial market.

Black Market Exchange Rate

Due to the limited availability of foreign currencies through official channels and the demand for stable stores of value, a thriving black market for foreign currency has emerged in Zimbabwe. The rates in the black market often deviate significantly from the official exchange rate and can fluctuate rapidly based on supply and demand dynamics. Many individuals and businesses resort to the black market for their currency needs, albeit with associated risks and potential legal implications.

Currency Restrictions

In an effort to control the flow of foreign currency and stabilize the economy, the Zimbabwean government has implemented various currency restrictions. These restrictions include limits on foreign currency withdrawals, restrictions on the movement of large sums of money outside the country, and regulations on the import and export of foreign currency. These measures aim to manage the availability and circulation of foreign currencies within the country.

Zimbabwe’s Efforts to Stabilize the Currency

Currency Reforms

To address the challenges facing the Zimbabwe Dollar, the government has implemented currency reforms aimed at stabilizing the economy. These reforms include measures to increase the supply of physical banknotes, enhance transparency in the foreign currency market, and attract foreign investors. However, the success of these reforms largely depends on broader economic stability and the restoration of confidence in the Zimbabwean economy.

Monetary Policy

The Reserve Bank of Zimbabwe plays a pivotal role in formulating and implementing monetary policy to stabilize the currency. This includes managing interest rates, controlling money supply, and regulating the foreign exchange market. The effectiveness of monetary policy in achieving currency stability is closely tied to various macroeconomic factors and the overall health of the Zimbabwean economy.

International Support

Recognizing the challenges faced by Zimbabwe’s currency, international organizations such as the International Monetary Fund (IMF) have provided support and guidance to the country. This support aims to assist Zimbabwe in implementing reforms, strengthening institutions, and promoting economic stability. International support plays a crucial role in creating an enabling environment for currency stabilization and economic recovery.

Economic Impact of Currency Issues

Inflation

The history of hyperinflation and ongoing currency challenges have had a profound impact on Zimbabwe’s economy. High inflation erodes the purchasing power of the currency, making it difficult for businesses and individuals to plan and invest. It can also lead to economic distortions, such as reduced savings, limited access to credit, and decreased foreign investment. Managing inflation and restoring confidence in the currency are essential for sustainable economic growth.

Foreign Investment

Currency instability and associated economic challenges have a significant impact on foreign investment in Zimbabwe. Investors value stable and predictable economic environments, and the volatility of the Zimbabwe Dollar has deterred many potential investors. Restoring confidence in the currency and implementing consistent economic policies are critical for attracting foreign investment and promoting economic growth.

Economic Recovery Efforts

The challenges faced by Zimbabwe’s currency have necessitated extensive economic recovery efforts. These efforts include implementing structural reforms, promoting transparency and accountability, and encouraging investment in key sectors such as agriculture, manufacturing, and mining. Overcoming the currency issues is essential to create a conducive environment for economic recovery and sustainable development.

Zimbabwe Currency FAQs

Why did Zimbabwe experience hyperinflation?

Zimbabwe experienced hyperinflation due to a combination of factors, including excessive money printing, fiscal mismanagement, economic sanctions, and political instability. These factors eroded the value of the currency, leading to a rapid increase in prices.

Can foreign currencies be freely used?

While the Zimbabwe Dollar is the official currency for domestic transactions, foreign currencies are still widely accepted in certain sectors of the economy. Many businesses, particularly those involved in international trade or tourism, accept foreign currencies as payment. However, there may be restrictions on the movement and use of foreign currencies, as regulated by the government.

What is the current value of the Zimbabwe Dollar?

The value of the Zimbabwe Dollar fluctuates and is subject to market forces. It is recommended to check the current exchange rate against major foreign currencies before engaging in any currency transactions.

Conclusion

The history of Zimbabwe’s currency is marked by significant challenges, including hyperinflation, the abandonment of the local currency, and the subsequent adoption of foreign currencies. The recent reintroduction of the Zimbabwe Dollar aims to regain control over the monetary system and reduce reliance on foreign currencies. However, the currency continues to face hurdles in gaining widespread acceptance and maintaining stability. Economic recovery efforts, currency reforms, and international support play critical roles in stabilizing the Zimbabwean currency and fostering sustainable economic growth.